inheritance tax rate indiana

Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. State inheritance tax rates range from 1 up to 16.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

In 2021 the credit will be 90 and the tax phases out completely.

. Inheritance tax was repealed for individuals dying after December 31 2012. In 2017 this rate fell to 323 and remains there through the 2021 tax year. However the inheritance tax was an issue for those transferring large amounts of capital.

Indiana has a three class inheritance tax system and the exemptions and tax rates. Select Popular Legal Forms Packages of Any Category. Class A Net Taxable Value of Property Interests Transferred Inheritance Tax 25000 or less 1 of net.

However many counties charge an additional income tax. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

The act was amended in 1915 1917and 1919. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. In 2021 the credit will be 90 and the tax phases out completely.

In 2021 the credit will be 90 and the tax phases out completely. Estates over the first. In Maryland the tax is only levied if the estates total value is more than 30000.

Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess. In 2021 the credit will be 90 and the tax phases out completely. The Probate Process In Indiana.

In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. In additon no Consents to Transfer Form. Spouse Children Grandchildren Parents Effective July 1 1997 the first 10000000 of an estate going to an heir in Class A is exempt of inheritance tax.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Indiana has a flat statewide income tax. The inheritance tax rates are listed in the following tables.

No tax has to be paid. So no inheritance tax returns Form IH-6 for Indiana residents for Form IH-12 for non-residents have to be prepared or filed. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary.

For most decedents estates there was no or very little Indiana inheritance tax. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. Inheritance tax usually applies when.

All Major Categories Covered. By the appropriate tax rate. Tax rates can change from one year to the next.

Up to 25 cash back Each beneficiary except those who are entirely exempt from the tax must pay tax on the amount he or she inherited minus the exempt amount. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. The Iowa tax only applies to inheritances resulting from estates worth more than 25000.

In addition no Consents to Transfer Form IH-14. The Indiana law imposed an inheritance tax at progressive rates upon lineal and collateral relatives as well as strangers. No tax has to be paid.

Inheritance Tax Here S Who Pays And In Which States Bankrate

What Are Inheritance Taxes The Complete Guide Taxact

2022 State Tax Data State Debt State Revenue And State Tax Collections

Net Unrealized Appreciation Nua Bogart Wealth

Inheritance Tax Here S Who Pays And In Which States Bankrate

Dor Indiana Extends The Individual Filing And Payment Deadline

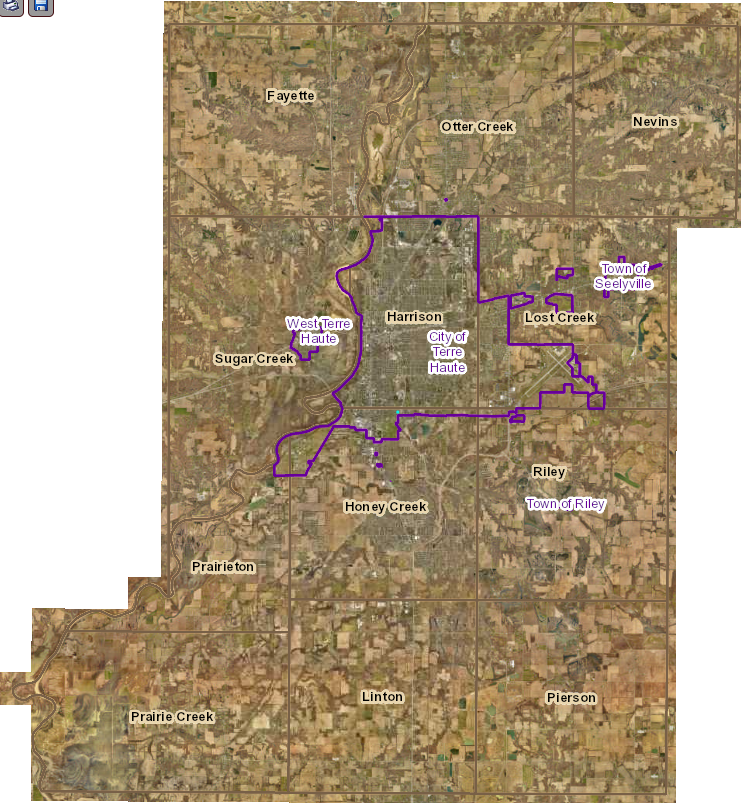

Assessorpurdue Extension Service Vigo Countyauditorclerk Of The Vigo Circuit Courtcounty Commissionersvigo County Coronercounty Courtscounty Councilharrison Township Assessorprosecutorvigo County Recordersheriff S Officesurveyortreasureradult

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

High Income Taxpayers Progressivity And Inequality Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Dor Indiana Individual Income Tax Tips Payments And Refunds

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Adler Estate Law A Legal Blog Written By Indiana Lawyer Lisa M Adler

Inheritance Tax Here S Who Pays And In Which States Bankrate